Image: (Right) President Biden Giving Infrastructure Speech via flickr, (Left) Veolia Logo via flickr

Biden Committee Advocating Water Privatization is Filled with Private Water Interests Set to Profit

In the lead up to the 2024 presidential election, President Biden has been focused more on infrastructure than perhaps any other issue. The President has touted his bipartisan infrastructure bill that passed in 2021 and has been running ads in states like Pennsylvania, Nevada, Wisconsin, and Arizona talking about his Clean Energy Plan housed within the Inflation Reduction Act. The ads emphasize the potential for good jobs in clean energy and other ads running concurrently have highlighted the savings on Americans’ utility bills. So when a report about water infrastructure came out of Biden’s National Infrastructure Advisory Council (NIAC), utility affordability advocates and labor unions took notice.

The report, however, argued that to rebuild the nation’s crumbling water infrastructure, the federal government should “remove barriers to privatization, concessions, and other nontraditional models of funding community water systems.” Public water advocacy group, Food and Water Watch, immediately put out a press release criticizing the report, saying that “[p]rivatization would deepen the nation’s water crises, leading to higher water bills and less accountable and transparent services.” Food and Water Watch has done extensive research on the privatization of water utilities. In a report put out in 2016, the group found that customers of private water corporations paid about 59% higher rates than customers of public water systems.

| The National Infrastructure Advisory Council was created in October 2001, after September 11th, to advise the White House, through the Department of Homeland Security and the Cybersecurity and Infrastructure Security Agency on “how to reduce physical and cyber risks and improve the security and resilience of the nation’s critical infrastructure sectors” according to the Cybersecurity and Infrastructure Security Agency (CISA) website. |

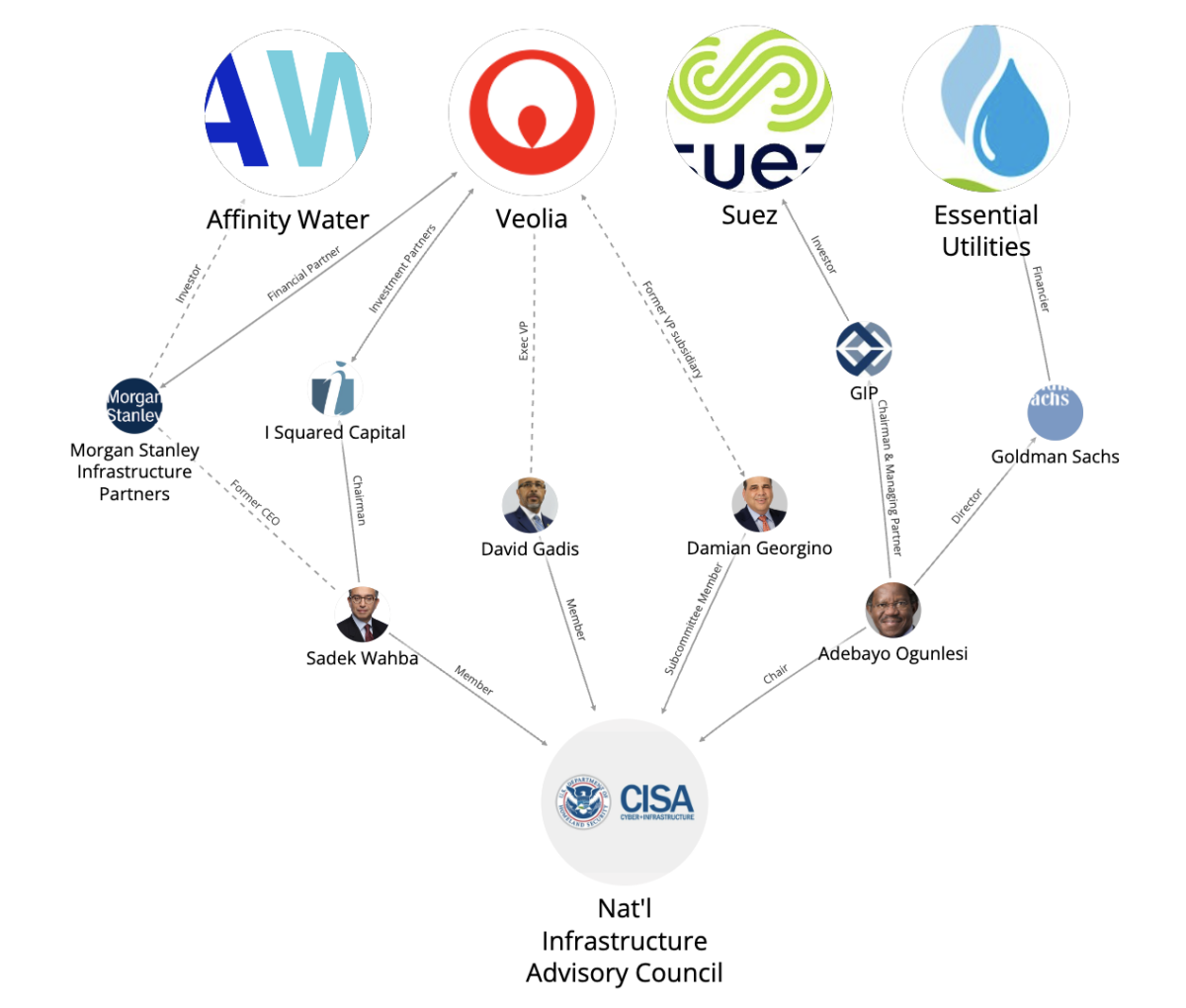

In the Food and Water Watch statement, Public Water for All Campaign Director, Mary Grant, also called out Biden’s appointed Chair of the Advisory Council, Adebayo Ogunlesi. Ogunlesi is Chairman and CEO of Global Infrastructure Partners, an investment bank that has over $100 billion in assets, including privatized water infrastructure. The NIAC report did not note the inherent conflict of interest for Ogunlesi, who would stand to potentially make millions of dollars if Biden’s administration decided to follow the recommendations of the report.

The connections between the private water industry and the National Infrastructure Advisory Council do not stop with Ogunlesi. Several other members of the NIAC have deep ties to corporations that not only stand to make billions if the federal government makes it easier to privatize public water systems, but have also done so much damage to American drinking water already. Below are several examples of these ties.

NIAC Chair, Adebayo Ogunlesi – Chairman and CEO of Global Infrastructure Partners

Ogunlesi is a Founding Partner and current CEO of Global Infrastructure Partners (GIP), an infrastructure investment firm that operates about $100 billion in assets. As one of the world’s largest infrastructure investors, Agunlesi’s firm manages infrastructure assets ranging from energy production and telecommunications to water and wastewater services. The firm’s portfolio includes french private water company Suez, which has a long and historical record of water privatization. In 2022, rival company Veolia acquired billions of dollars in Suez’s assets, leaving room for GIP to step in and acquire 40%, or about $4.4 billion in shares, of what is now called “New Suez.” Under the leadership of GIP and Meridiam (also a 40% shareholder), New Suez continues to operate private water systems all over the world in Europe, Asia, and Africa, extracting nearly $7 billion in revenue in 2022.

While Suez is a global company, it has had many contracts to run water systems in the United States that have gone awry. For example in Camden, New Jersey, Suez won a contract to run the water and wastewater system in 1998. By 2019, the City of Camden and Suez had filed competing lawsuits against each other with the City alleging that Suez had failed to uphold its promises and that the corporation was responsible “for excessive water loss, inadequate maintenance and billing problems.”

For over a decade, Ogunlesi has also served on the board of Goldman Sachs, one of the largest investment banks in the world. Goldman Sachs has a history of pushing water privatization efforts. Not only has the firm provided billions in financing to Essential Utilities, one of the largest private water corporations in the United States, but Goldman Sachs also allegedly pushed for the privatization of Chicago’s water system in 2015.

NIAC Member David Gadis – Former Executive Vice President at Veolia North America

David Gadis is currently the CEO and General Manager of DC Water, a publicly owned and operated water utility. Prior to working in the public water sector, Gadis served as Executive Vice President of Veolia North America, where he oversaw a track record of historic mismanagement.

At Veolia, the largest private water company in the world, Gadis was put in charge of the company’s growth strategy in North America. Under Gadis’s leadership, Veolia faced several major public relations crises. First, the company had been brought in as a consultant early on in the Flint water crisis and its executives (including Gadis) knowingly gave false information to the public about Flint’s water being safe to drink. At around the same time, Veolia North America was managing the Pittsburgh Water and Sewer Authority under a public-private partnership. After only a few years, the corporation had laid off water testing staff, sent out thousands of inaccurate bills, and oversaw an illegal change in the corrosion control chemical used to keep lead out of Pittsburgh’s drinking water. The City’s then Mayor terminated Veolia’s contract early and filed a lawsuit against the company for underperformance and botching its management duties.

NIAC Member Sadek Wahba – Chairman and Managing Partner at I Squared Capital

Sadek Wahba is Chairman and Managing Partner at global investment management firm, I Squared Capital. The private investment firm manages a portfolio of over $15 billion that targets infrastructure investments, including in private water and wastewater management. Only a year after Wahba began his tenure at I Squared Capital, the firm partnered with Veolia to acquire a power plant outside of Boston. Wahba’s firm has also bought up water and wastewater facilities in China, and its primary fund, the ISQ Global Infrastructure Fund, reportedly has about half of its portfolio in water, wastewater, and transportation assets around the world.

The NIAC report on water cites a project in Texas where a Morgan Stanley owned private water company entered into a public-private partnership to build a water desalination plant. This relatively small and specific example may be highlighted because prior to his tenure at I Squared Capital, Wahba was the CEO of Morgan Stanley Infrastructure Partners. This branch of Morgan Stanley is an investment firm that also owns private water assets and has a long standing financial relationship with Veolia. In 2012, Morgan Stanley purchased Affinity Water, previously an asset of Veolia in the UK, and the bank acted as Veolia’s representation and partner in a 2009 purchase of a Boston based power plant. Both of these transactions took place while Wahba was a top executive at Morgan Stanley Infrastructure Partners.

After the NIAC report was released, Wahba also wrote a piece for Forbes Magazine stating that “[w]hat is needed is increased use of public-private partnerships, with private companies taking over some aspects of water system operation, and concessions, in which a private company would modernize the system in return for the right to collect user fees.” In other words, investment firms like Wahba’s claim they would make investments in the country’s water infrastructure, but only if they are allowed to then extract billions from customers who need water to live.

NIAC Subcommittee Member, Damian Georgino – Partner at Womble Bond Dickinson

Damian Georgina is a long time water privatization advocate and lawyer, specializing in mergers and acquisitions. He claims to have “successfully led numerous water and wastewater privatization and [public private partnership] projects in the U.S. and throughout the world.” He advised private equity firm Crestview Partners in its investing in private water company Upwell Water. He was also Executive Vice President of Corporate Development and Chief Legal Officer of PICO Holdings Inc, now called Vidler Water Resources, a “water broker” company. Over a 20 year span, Vidler bought up scarce, untapped water reserves in the Western United States, drilled wells, and made millions by selling the rights to them one well at a time: the exact playbook that private water corporations now want to use around the globe.

Prior to these positions, Georgino had been Executive Vice President, General Counsel and Corporate Secretary for United States Filter Corporation, a water treatment company. He left the company a few months after it was acquired by Veolia (then called Vivendi) for $6.2 billion. Georginio then co-founded his own infrastructure investment firms, Sewickley Capital Partners and Cyan Technology Partners to invest in private water and wastewater corporations.

Outside of just these connections to water profiteers, the NIAC also includes members representing the oil and gas industry. This is important not only because the Council is also making recommendations on the nation’s energy infrastructure, but because the corporations that these members represent are the very corporations responsible for driving climate change globally and making safe, clean drinking water an even scarcer resource. NIAC members like Alan Armstrong, CEO of Williams Oil and board member at the American Petroleum Institute, Gil Quiniones, CEO of Commonwealth Edison (an Exelon electric utility company), and Audrey Zibelman, former Executive at Xcel Energy, lead companies that are contributing to climate change while also being called on to help the President mitigate the impacts of climate change on water resources.

As clean and affordable drinking water becomes a more scarce resource around the world and especially in parts of the United States, it is critical that the federal government seeks the advice of experts and puts together teams like the National Infrastructure Advisory Council to give recommendations on how to overcome these challenges. However, the President should not seek the advice of infrastructure tycoons with an expertise in profiting off of our vital natural resources – especially not from those tied to corporations that have been fired for poor performance in infrastructure management and have had multiple lawsuits filed against them. Further, the President should not seek advice from people whose business operations would stand to profit if their recommendations were heeded.

Recommendations on how to ensure drinking water is safe and accessible to all Americans should come from real experts on water democracy, sustainable water management, front line communities in the battle against climate change, and Indigenous leaders that have fought for centuries to protect their community’s access to clean water.

At the same time, there are private stakeholders that stand to make billions of dollars by taking advantage of the scarcity of water and investing in privately owned water assets that end up costing American families in the long run. When private corporations take over water assets, as the National Infrastructure Advisory Council recommends, they have a responsibility to extract profits for their shareholders and thus prioritize profits over everything else, including clean water, customer service, long term infrastructure investments, and keeping water rates affordable for all. Appointing several people with significant financial ties to some of the largest water profiteers in the world like Veolia and Essential Utilities to the National Infrastructure Advisory Council is like letting wolves into a hen house. As Mary Grant of Food and Water Watch stated plainly in her statement: “President Biden should have never appointed an investment banker to chair an advisory council for the nation’s infrastructure.”