Three weeks ago, Matt Taibbi kicked off the latest anti-Goldman Sachs media cycle with a brilliant polemic in Rolling Stone. His opener achieved meme status long before the full article even appeared on the web:

The first thing you need to know about Goldman Sachs is that it’s everywhere. The world’s most powerful investment bank is a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.

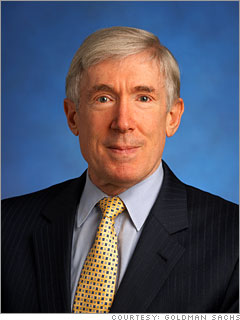

Today, the squid was at it again, albeit meekly. The Obama administration tiptoed out their most recent Goldman nominee late this afternoon — hoping, perhaps, that the Friday evening quiet would offer some cover from the next stage of the media cycle. Bob Hormats, vice chairman at Goldman Sachs international, is Obama’s pick for under secretary of state for economic, energy, and agricultural affairs.

Goldman had been shaken by the Taibbi piece, enough to respond to it with charges that the writer was “hysterical” (prepared statement?). Their spokesperson told Felix Salmon that Goldman’s partners had “pretty much lost their appetite for going into public service,” after all the negative attention they had been getting over the past two years.

But Hormats still has the stomach, brave soul! Public service clearly means too much to him for cutting prose to keep him out of the halls of government.

Hormats, as it turns out, could make for a strong symbolic punching bag for the anti-Goldman movement; he’s exemplary, on several counts:

1. He came up under Kissinger at the National Security Council during the 1970s, which means that he learned his ways from an honest-to-goodness mastermind of international conspiracies. Actual conspiracies — see Christopher Hitchens.

2. His new position will give him a role in shaping international financial and energy regulation. Taibbi’s piece focused on the international commodity bubble that Goldman manufactured last summer; it’s only natural that Hormats would get the nod to figure out what, exactly, went wrong with that market, and fix it. This is what the squid does.

3. Hormats has offered some really unfortunate reflections on Goldman’s dominance of government. From Alan Rothkopf’s recent book on 6000 people who run the world, called Superclass:

It is remarkable that there has been a relatively low level of outcry about the steady flow of executives from 85 Broad Street [Goldman headquarters] to offices inside the beltway. Vice chairman of Goldman Sachs International Bob Hormats, himself a senior official, said, “It is fairly unusual…I think it is because it has been demonstrated that when Goldman Sachs people get into these jobs, they give no preference to Goldman Sachs. There is no shred of evidence that they use any of their influence on behalf of Goldman Sachs. If there were, just once, given the remarkable activity of Goldman Sachs in the private sector, it would be over. There would be an incredible hue and cry.”

With any luck, the hue and cry will continue, the nomination will get held up, and these words will come back to haunt him.